Local Councillors who have just been elected are now seeking to up their pay by a factor of 600% or more

Link to Herald-Sun storyThere are serious questions that need immediate answers.

SHOULD not any increase in councillor allowances have been set before the election as opposed to after the fact?

In the City of Casey's proposal its a bit like someone applying for a job with the salary of a paper boy and having secured the appointment then grants themself a salary equal to the editor in chief.

How many more people with professional skills would have nominated for election if the salary was known to be significantly higher then currently set?

Something is wrong and it needs fixing NOW.

Then there is the back door approach. More lurks and perks, benefits - free cars, petrol, central car-parking, unlimited cab charge vouchers, overseas holidays, frequent flyer bonus points, computers, secretarial support, free mobile telephone, free fax, free internet, free child-care, free theatre tickets, free football matches, free meals (lunches) and free alcohol.

It is never ending and there must be some limits and controls. Some form of governance. Are all these benefits subject to the Fringe-Benefits Tax? If yes is the Council expected to pick up the tab on the tax also? Are they paying the Fringe-Benefits tax? Victorian Local Government Act 1989

Councillors allowances are governed by the Victorian Local Government Act 1989 section 74 (A, B, and C) and section 75 -

(Extract below)Section 74 (1) says the Council MUST within 7 months of the general election determine the level of allowance to be paid to councillors for the next four years.

Section 74 (3) refers to any variance of the above.

Section 74B provides the Government with the option of limiting the amount of allowances paid to Councillors by order of the Governor in Council

Section 74C provides for the appointment of an allowance review panel BUT the government MUST accept the recommendations of the Panel. It's locked in - hands tied. You would want to have complete trust in the panel and ideally know the outcome before hand.

Section 75 allows for Councils to reimburse Councillors for out-of-pocket-expenses arsing from their duties as a Councillor.

There are other provision related to review panels but they all apply to any variance after the initial 7 month allowance determination made by the Council under section 74(1).

According to the Municipal Association of Victoria (MAV)

Councillors are not considered employees of their council and do not receive employment benefits such as a salary, superannuation and leave entitlements.

Councillors receive an allowance as fixed by an Order in Council, which commenced operation on 1 July 2001.

Under this Order, the minimum allowance that can be received by a councillor is between $5,000 and $18,000 depending on the revenue and population base of each council. Each council determines the amount to be paid to councillors within specified limits. Mayors receive a larger allowance due to their increased workload and role.

Councillors who reside in remote areas more than 50 kilometres from the location/s specified for the conduct of any authorised council business can be paid an additional allowance of $40 for each day they attend authorised meetings or functions. A maximum payment that can be received by a councillor under this provision is $5,000 per annum. Councils generally set a policy for the provision of administrative support, resources, facilities and reimbursement of a councillor’s travel and out-of-pocket expenses. Councillors are also provided with secretarial support and telecommunication aids such as fax machines, internet access and mobile telephones.

Income equivalent to a councillor’s allowance will need to be included in their taxation return. Councillors can decline to receive an allowance, in which case no tax would arise. Councillors are also entitled to deduct expenses relevant to their election costs and activities as a councillor.

The Australian Taxation Office sets limits for election expenses that can be deducted from a candidate’s income tax. (No mention of the requirement to pay Fringe-Benefits Tax - it pays not to ask too many questions).We would be keen to know what advice Casey Council has obtained and if under the act the Council can set what ever additional allowances they think fit under the terms of out-of-pocket expenses - until such time as the Government Acts to limit the extent of additional allowances paid to Councillors -

The sky is the limit.

It seams that every Council has opted to pay the maxium amount possible including additional expenses and now some want more. It is messy but we think the Local Government Minister has been asleep on this one. We raised this issue a year ago but received no reply.

Questions that have not been answered.

SECTION 75 refers to out-of-pocket-expenses incurred while performing duties as a Councillor or committee member.

This is where the fun begins. It seams there is a wide definition and interpretation as to the meaning of out-of-pocket expenses. The Australian Tax department might refer to it as Fringe-benefits as opposed to business expense. We call it the lurkes and perks of office - Out of your pocket and into theirs.DOES out-of-pocket-expenses include costs associated with Councillors who hold executive positions of a third party organisations with whom a Council is affiliated or should these costs be paid for by the third party organisation?

Can a persons duties of a third party organisation also be considered directly related to the performance of duties as a Councillor? Surely they are separate entities and as such can not and should not fall under the provisions of section 75? If you happen to be an ex-officio member of your local golf club, because you are the local councillor, and are subsequently appointed to the executive of the Golf Club does that mean costs associated with your executive position of the golf club are out-of-pocket expenses related to your duties as a councillor? Can you travel to the US open golf tornament and ask the Council to reimburse you the costs of the trip?

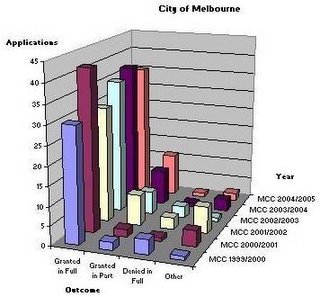

In the City of Melbourne's case

Green Councillor Frazer Brindley has been appointed Council delegate to ICLEI

(International environment organisation run by former Melbourne City Councillor Martin Brennan) Cr Brindley has now been appointed to the executive of ICLEI

(primarily because the City Council will pick up the tab) which meets regularly all around the world.

(As part of his duties as an ICLEI executive member he needs to fly around the world to attend executive meetings generating excessive amounts of green house gases and Co2 emmissions - Why can't they use the internet video conferencing?)Should the City of Melbourne pick up the costs associated with Cr Brindley's executive position of this third party organisation ? Does it fall under the provisions of section 75 of the Local Government Act arising from his duties as a Councillor? Is it not the responsibility of the third party organisation to meet its own costs of governance?The onus is now on the Victorian Local Government Minister, Candy Broad, to address these issues and, if it hasn't already been done, set reasonable limits so that corrupt Councillors do not raid the cookie jar.

Link to extract of Victorian Local government Act stored in comments

Victorian Legislation and Parliamentary Documents

Part 4—Council Administration

Local Government Act 1989

Act No. 11/1989

Sections 74 and 75

Issues such as an Australian republic and a new flag that better represents Australia as a developing nation. Victoria should also adopt a new State flag. (The issue of a republic - hopefully a model without a direct elected head of state - will be soon back on the agenda with John Howard's expected retirement)

Issues such as an Australian republic and a new flag that better represents Australia as a developing nation. Victoria should also adopt a new State flag. (The issue of a republic - hopefully a model without a direct elected head of state - will be soon back on the agenda with John Howard's expected retirement)